If you have a huge capital gains or about to have one (selling on or before 30 June) for the current financial year, you can reduce your potential CGT liability by using the Unrealised CGT Report to identify investments sitting at an unrealised capital loss.

What you do is set the report to 30 June 2025, you should see the capital losses section. This shows you all the holding parcels that would incur a loss should you sell them at the current market price.

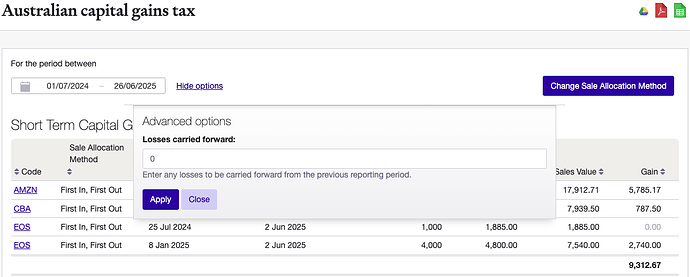

Once you have decided the parcels or the amount of losses you can realised, enter that amount in the CGT Report under “Losses Carried Forward” field. This is a quick way to understand how that will change your CGT liability.