Hi, any know what the cost base adjustments are for the Tabcorp demerger ?

There is a capital reduction component, but it’s yet to be released. I’ll update this thread once it is announced.

Thanks Jack

@Jack_Sharesight Hi Jack, TAB or the ATO are taking a long time to give us the details of the adjustments needed for the TAB / TLC demerger. I haven’t added any TLC shares into my SS portfolios as yet and my TAB shares are of course showing a big loss, when in fact there is a bit of a gain overall. Is there any short term entry I can make now for TAH and TLC that would give a clearer picture of overall performance while we wait for more details. Even if it is still somewhat inaccurate, but much less inaccurate. ( I assume that we would then just delete any short term entry made and put in the correct final entries). This wouldn’t be a problem if June 30th wasn’t fast approaching. Any recommendations?

So in the meantime, you can enter your TLC shares as an opening balance. You can update the TAH capital reduction once this information is released

Opening Balance and I add no cost base or share price on that day? Is that correct?

ATO Class Ruling CR2022/58 had been released:

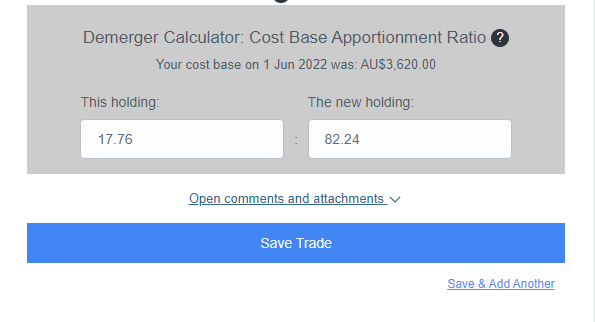

In summary the split is TAH 17.76%: TLC 82.24%

Hi I had multiple buy transactions for TAH. I presume I need to manually go back for each trade to adjust for the share purchase price at 17.76%, and create a new ‘Buy’ for TLC for 82.25% of original holding? How is brokerage split on the same basis?

Hi Andrew,

I did what was described on the page below for the Woolworths/Endeavour demerger which was similar to what happened TAH, but just replacing the percentages of the demerger entities.

It worked for me so you might want to give that a go.

Thanks Evan much appreciated. Exactly what I was looking for to help with this corporate action.

Hi Evan just one other question, however I appreciate you might not know the answer.

When I apply the changes my cost base is calculating as expected and lower than the price at demerger, as well as current market valuation, however Sharesight calculates I have a negative capital gain when it reports performance for this stock.

I’m at a bit of a loss as to why it wouldn’t be reporting this as a gain on the performance, and what it may do in the future if I sell these shares. Any insights?

Hi Andrew,

Yes, I had the same thing. Sharesight seems to use the close price of TLC on the day you specified the demerger to happen for performance calculation purposes. It does throw things off a little of me as well, since the close price on the demerger was higher than the current price even though the actual cost base is lower than that.

However, when I run an unrealised cap gains report, it does show TLC with the right cost base and under long term cap gains as well so I suppose should you eventually sell it, it’ll be correct for tax purposes.

Evan

@AndrewC so with the cost base reduction trade, enter the components as below:

Then use the reduction amount as your cost base for your new TLC shares.

With the unrealised gain for TLC, it will base on the price at the close of the merger date. This will change once the gains are realised within the CGT report, based on the cost base determined when entering the shares. As time goes on you should get a decent outlook on the unrealised gains as more data populates.

Hi Jack, Thanks as always.

Just quickly double checking, if you use the opening balance to enter the TLC share, when you sell TLC shares (assuming you hold TAH longer than 1 year+ in the first place), the CGT discount will automatically be picked up in the Sharesight CGT reporting right? Many thanks.

Yes! So any opening balances entered will assume that the holding has been held for more than 12 months, so the CGT discount will apply to TLC shares.

Hi Jack, new to Sharesight, joined just to ask this question on this thread! Hope you don’t mind. I do want to explore Sharesight more, but also brand new to shares, and it has been a struggle to get my head around everything share related, so one step at a time. We chose the sale facility for our TAH (and TLC) shares, only had a handful, left over from a very old employee scheme. Offloaded them years ago, but accidentally got left with a few. So having to deal with them in tax for the first time. Sending me into meltdown! Have read the Class Ruling (many times). Makes no sense to me at all. Tempted just to give up and whack a random overstated CGT figure in our tax return in the hope ATO won’t care because we’re not undercutting them. I think I’ve established that hubby first needs to ring Link Market Service to try to ascertain the date he acquired the shares under the employee scheme (maybe 10-15 years ago, from memory), and the value they were allocated at that time. Then do I need to just calculate the difference between the value of the post-merger TAH price $1.016 (from what I can ascertain from the class ruling) and the allocation price when hubby was given the TAH shares under the scheme? And the difference (if the difference is positive) is the gain? And then we take 50% discount off that? And declare what is left as capital gains? I’m not sure how to treat the TLC shares, as they were acquired as part of the demerger of course, so I don’t know how to ascertain their pre-demerger value in order to calculate difference with post-demerger value. Hoping I don’t have to get involved in the 17.76%/82.24% stuff I was reading about, cos literally have no idea what that means! Hoping someone can help but realise this is a very specific situation. Thanks greatly.

Hi! Welcome to Sharesight and the community! ![]()

So firstly, all of the suggestions are purely based on how to enter these into Sharesight. Anything tax and CGT-related, you should definitely seek advice from a tax accountant for reporting!

So first, you would enter your TAH shares based on when you first acquired these. It sounds like this is an employee share scheme(?), so you can follow along with the below article for entering these in:

You’ve also mentioned you disposed of a lot of these shares? Was this by selling the shares?

Once we’ve worked out the way to get you to what is remaining, then we can work through how to deal with the rest of the demerger.

As this is more specific to you, if you haven’t already, please do reach out to our support team directly via the chat icon on the bottom-right of your portfolio page ![]()

Have followed this guide (replacing the relevant percentages) however when adding the new TLC holding an additional step is required - entering the “unit / share price”

Should this be the average calculated “average cost per share” shown or the TAH market price on the 23/5/22? (or something else!)

So the cost base will be what the value is of the Adjust Cost Base trade that you entered for TAH. The price will just be the market price on the implementation date.